Are you working for your business or is your

business working for you?

We start with your desired exit and work backward to today.

From Growth to Exit: What is the Value of Your Business?

Benchmark: Owner Independence = Freedom.

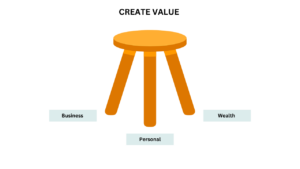

True value in a business isn’t just about the numbers; it’s about how you spend your time, the growth of your personal wealth, and the tangible and intangible worth of your business. It means having clarity, alignment, and taking purposeful actions in three key areas:

- Personal Aspirations: Are you spending your time the way you want? Is your business allowing you to enjoy your life, or is it consuming you?

- Business Ambitions: What is your business worth today, and how much value are you building for tomorrow? Are you optimizing profitability now, and could you sell for the price you want when the time comes?

- Personal Wealth: Are you making the money you want now, and are you saving enough for the future?

When I ask business owners about their exit strategy, I often hear, “I haven’t thought about it; it’s far off,” or “I’m just focused on getting through today.” Some aim to simply “make money,” but that isn’t a strategy. If you don’t know your endgame, how do you know if what you’re doing today is moving you in the right direction?

When I ask business owners about their exit strategy, I often hear, “I haven’t thought about it; it’s far off,” or “I’m just focused on getting through today.” Some aim to simply “make money,” but that isn’t a strategy. If you don’t know your endgame, how do you know if what you’re doing today is moving you in the right direction?

At AccelerateGrowth45, we are all about enhancing value—growing your business, revenue, profits, and time. But we focus on starting with the end in mind and working backward. Your exit strategy is not just about selling; it’s about knowing where you’re headed, even if that’s 5, 10, or 15 years from now. Planning early can ensure that you’re prepared for whatever comes—whether it’s the opportunity to sell at a high point or handling unexpected challenges.

Whether you plan to exit by choice because the business is thriving, or you need a contingency plan for unforeseen events, focusing on value today ensures you’re prepared. It’s about creating a business that works for you—not the other way around.

Value Enhancement Process

This stage focuses on understanding the current value of the business and setting clear goals. It involves gathering comprehensive data through fact-finding and conducting a structural review. The process includes a financial analysis, benchmarking against industry standards, and assessing non-financial factors to determine the overall valuation. The goal is to identify opportunities for improvement and establish a clear starting point for future growth.

Once the business’s value is identified, the next step is to protect it. This involves financial planning and preparing for unplanned events that could impact the business, such as economic downturns or unexpected challenges. De-risking is critical here, focusing on reducing dependency on key individuals, addressing operational risks, and ensuring the business can withstand disruptions. This stage ensures that the existing value is safeguarded against unforeseen threats.

This stage is about strategic growth and making the business more attractive to buyers or investors. It includes refining the business model for efficiency or expansion, optimizing financial performance, and improving systems and procedures. Marketing and sales strategies are also enhanced to boost revenue, while corporate governance and leadership development are prioritized to ensure a solid structure. The aim is to increase profitability and scalability, creating a strong foundation for future success.

As the business reaches maturity, the focus shifts to extracting value through a potential sale or liquidity event. This involves preparing documentation such as an Information Memorandum and conducting due diligence to ensure all aspects of the business are ready for sale. It’s about positioning the business for a smooth transition, ensuring that owners can realize the maximum financial return from their hard work.

The final stage focuses on managing the wealth generated from the business, ensuring it continues to provide value even after a sale or transition. This includes ongoing investment planning to grow wealth, asset protection strategies to secure financial gains, and estate planning to ensure long-term financial security. This stage ensures that the benefits of the business’s success continue into the future, supporting the owner’s personal and financial goals.