1st – START WITH THE END IN MIND.

2nd – WAKE UP TO YOUR CURRENT REALITY.

3rd – KNOW HOW TO GET THERE, THEN DO IT.

When I ask business owners about their exit strategy, I often hear, “I haven’t thought about it; it’s far off,” or “I’m just focused on getting through today.” Some aim to simply “make money,” but that isn’t a strategy NOR DOES THAT EQUAL VALUE.

If you don’t know your endgame, how do you know if what you’re doing today is moving you in the right direction?

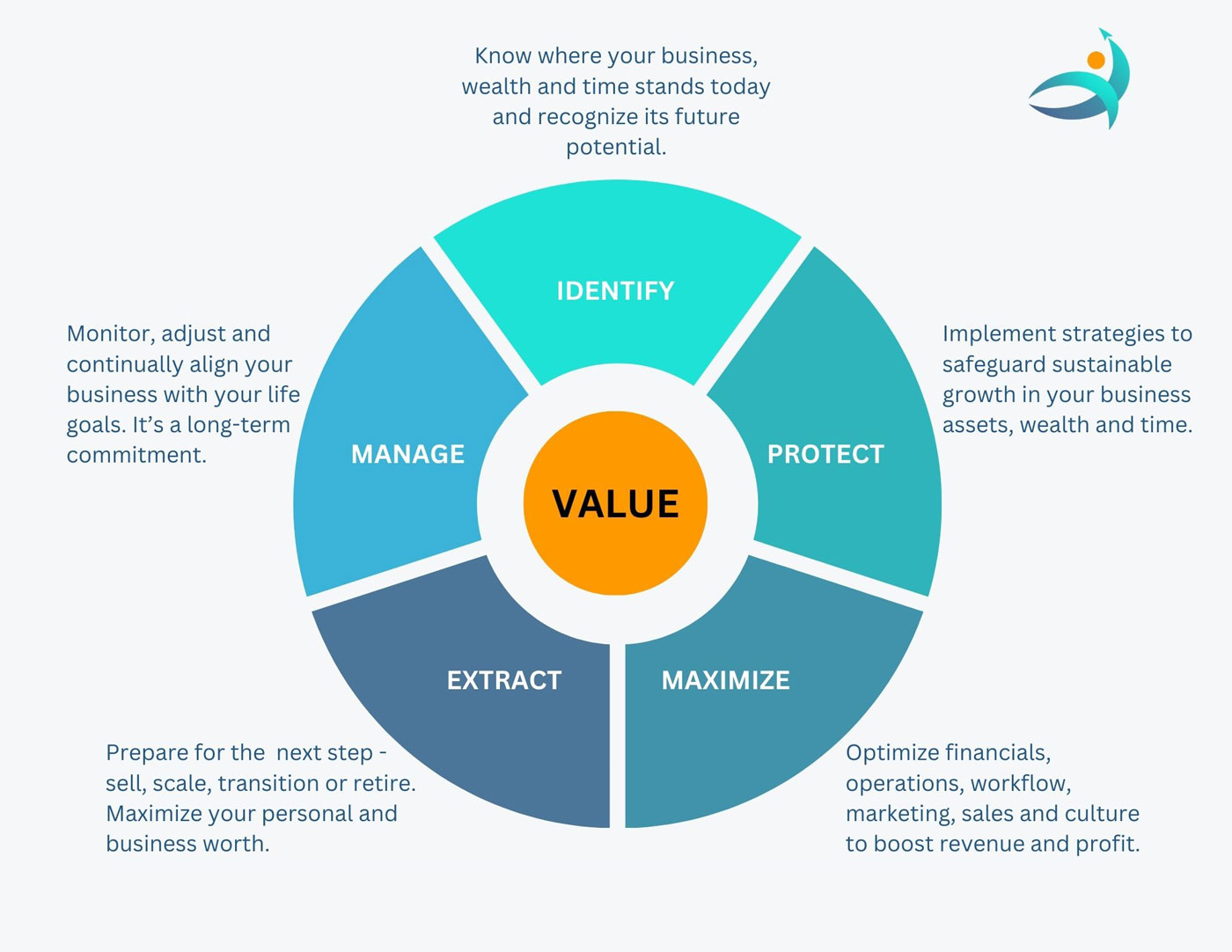

WE FOCUS WITH THE END IN MIND AND WORK BACKWARDS GROWING VALUE IN YOUR PROFITS, WEALTH AND TIME.

Your exit strategy is not just about selling; it’s about adding value and knowing where you’re headed, even if that’s 5, 10, or 15 years from now. Planning early can ensure that you’re prepared for whatever comes—whether it’s the opportunity to sell at a high point or handling unexpected challenges.

Whether you plan to exit by choice because the business is thriving, or you need a contingency plan for unforeseen events, focusing on value today ensures you’re prepared. It’s about creating a business that works for you—not the other way around.